Venezuela Shock: Political Regime Risk, Not an Oil Supply Revolution

- Abrar Yousuf

- Jan 4

- 4 min read

What Happened?

On the morning of Saturday, January 3rd, millions of people around the world awoke to the extraordinary news that the United States military, acting under the authority of President Donald Trump, had launched a coordinated operation resulting in the capture of Venezuelan President Nicolás Maduro. The development followed weeks of escalating diplomatic and media tensions between the two states and their respective leaders. President Trump had repeatedly accused Maduro of responsibility for the illegal trafficking of drugs, including cocaine, into the United States, allegations which Maduro has consistently denied.

The operation has been widely criticised as a breach of international law, although reactions from other world leaders have, on the whole, been notably restrained. Maduro has been indicted in New York on charges relating to narcotics trafficking and weapons offences.

At a press conference later that afternoon, President Trump announced that the United States would assume control of Venezuela until such time as a “safe, proper, and judicious” political transition could be achieved. In a particularly controversial statement, he further declared that American oil companies would repair Venezuela’s oil infrastructure and begin generating revenue both for the Venezuelan people and for the United States.

Significant uncertainty remains over how the United States intends to “run” Venezuela. Questions persist regarding the potential deployment of troops, the degree of President Trump’s direct involvement, and whether opposition leaders will be afforded the opportunity to oversee a peaceful transition of power. What has, however, become increasingly clear is that the Trump administration views Venezuela’s vast oil reserves as a central strategic objective, a reality the President himself has made little effort to obscure.

What Next?

The immediate future for Venezuela is instability and a power vacuum, not a swift, U.S.-led transition. Public opinion is sharply divided by geography. According to a Latin Times-cited poll, about 64% of Venezuelans living abroad support the U.S. military intervention, while only 34% of those living inside the country agree, highlighting a stark gap between the diaspora's hopes and residents' fears of instability.

This sets the stage for three messy scenarios:

There are 3 messy possible scenarios:

A messy internal power struggle within the military and political elites.

"Chavismo without Maduro," where the existing regime reshuffles leadership and retains control using nationalist rhetoric.

Prolonged instability or partial state collapse, if armed factions reject any new authority.

The most likely outcome is a protracted period of uncertainty and contested control, where the population's desire for change clashes with a deep distrust of foreign intervention. This environment is hostile to the rapid large-scale foreign investment needed to revive the oil industry.

What is the Impact on Markets?

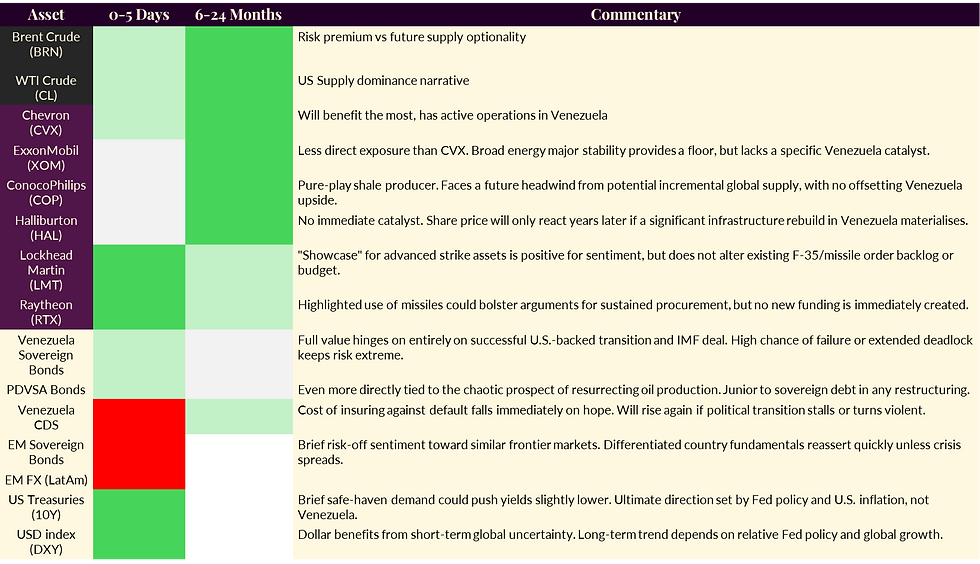

Markets will initially price a geopolitical risk premium into oil and related assets, but long term impact hinges on Venezuela's messy and uncertain political transition. The real money in oil and equities depends on the slow, difficult process of rebuilding a broken industry, not the capture of reserves as commonly thought. The event's main legacy is a higher "political risk premium" in global markets, not an oil supply glut.

In this scenario, what drives the price of both oils, is the question of "when will supply increase, and how credible is it?" since oil prices react to the expected near term supply, and not the theoretical long term capacity. There is no immediate supply shock, since Venezuela have severely degraded infrastructure, with a slow oil output of 1 million barrels per day. They have 17-20% of the global total, yet produce less than 1% of the world's supply. For reference, Saudi produce 9.8-10.5m barrels per day. Venezuela adds potential future supply, not immediate supply. It creates investor opportunity for a few companies now, but won't cause a sudden oil price crash.

The impact on energy equities will be massive. Chevron (CVX) are already on the ground and have joint ventures in Venezuela. It has been producing and exporting Venezuelan crude to the US under tight OFAC conditions. The real opportunities lie in which company gets first access and the best long-term deal. The Trump administration has talked about "the biggest oil companies" investing billions in rebuilding infrastructure, which implicitly points to supermajors and large-cap independents that have the balance sheets and technical depths. Beyond oil, the operation has also ignited a rally in defense stocks like Lockheed Martin (LMT) and Northrop Grumman (NOC). This surge isn't due to new contracts, but because the high-profile use of advanced bombers and missiles serves as a powerful, real-world showcase. It reinforces the long-term investment thesis that geopolitical risk is driving sustained demand for next-generation U.S. military hardware.

It is important to note that the long term performance hinges entirely on if there is a stable, internationally recognised regime and security on the ground. Big Oil companies like Exxon and Chevron won't commit their billions just because the political winds have shifted. Sanctions need to be formally lifted, and replaced with a long-term legal framework. Venezuela's oil industry isn't just run-down, it's completely broken. Lifting production is expected to cost $100 billion, and for a company to sign off on that, the forecast has to be solid and worth the risk.

Assets to watch: Chevron (CVX), ExxonMobil (XOM), ConocoPhillips (COP), Occidental Petroleum, APA, Marathon Oil.

Conclusion

This is indeed a historic escalation in US-Venezuelan relations, but it doesn't mark an immediate turning point for their economy or global energy markets. Although it has injected a short-term geopolitical risk premium into oil and defence asset, the long-term implications are highly uncertain and fundamentally political in nature. For markets, this event reinforces a crucial distinction - headlines can move prices briefly, but durable re-pricing requires clarity, credibility and execution. Until the new regime is clear, and investable, oil markets will still be driven by marginal global supply dynamics, rather the hypothetical capacity of the reserves. In that sense, the episode is less about an imminent oil boom and more about a prolonged period of elevated political risk shaping capital allocation decisions.

The moves will be more short term and politically driven, and long term outlooks will be more clear as more unfolds.

Sources

Disclaimer

This report is for informational purposes only and does not constitute investment advice or a solicitation to trade. The views expressed are solely those of the author. The information is based on public sources and is not guaranteed to be accurate or complete.

Comments